Mortgage Calculator

Calculate Your Mortgage Payment in SecondsMortgage Calculator

Plug the home purchase price into the field below and add your down payment, mortgage period and projected interest rate. The numbers below will change and recalculate as you make adjustments. If you want a printed version of your calculations just enter your email below and we will send them to you.

Are you ready to buy a house?

Getting pre-approved for a mortgage is an essential step in the home-buying process. It helps you understand how much you can afford and a pre-approval is best to have before writing an offer. Here are the steps to get pre-approved for a mortgage:

- Gather your financial documents. Lenders will require proof of income, pay stubs, T4’s & Notice of Assessments. Proof of assets such as bank statements, retirement accounts & other investments will also be required. Ask your employer for a proof of employment letter that includes your job title, time with the company, salary details & future employment reassurances.

- Make sure to have a copy of your driver’s license or passport.

- Have a list of current debts such as credit card statements, student loans & car loans.

To determine your housing budget, you need to calculate your Gross Debt Service (GDS) ratio. A good GDS ratio to get approved for a mortgage is under 39%, but it’s possible to qualify with a higher ratio. Check out this calculator to learn more about your GDS. https://www.cmhc-schl.gc.ca/consumers/home-buying/calculators/debt-service-calculator

Next you will need to choose a bank or a mortgage broker to set up a meeting with. Keep an eye on posted interest rates and use a mortgage calculator to get an idea of what is within your budget range. You can use our mortgage calculator on this page to get started.

Once you are approved, you’ll receive a pre-approval letter stating the mortgage amount you’re approved for, the interest rate & other terms. This letter is typically valid for 60 to 90 days.

By following these steps, you will be well-prepared to find your home. I am here to guide you every step of the way & of course, if you know someone who is considering buying, I would love your referral.

Happy house hunting!

We can’t thank Denise enough for her professionalism, expertise, and hard work in helping us find our first home. We highly recommend Denise Dykes to everyone!!!

Building Dreams for First Time Home Buyers

Buying a home is a significant milestone for many individuals, and saving for a down payment is often the crucial first step in this journey.

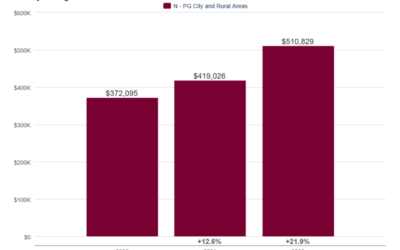

PG Market is on Fire

Over the last two years, the demand for homes continues to outpace supply, causing dramatic increases in price.

Why Get A Pre-Approval

If you are wanting to enter into the housing market, you should consider getting a pre-approval.

Denise Dykes is available to discuss your real estate needs!

Contact us today to set up a consultation